For years, international investors sought firms in the UK as a launching point to trade assets all over Europe (and, likewise, European firms to trade in UK). Due to Brexit, that will all change on March 29th, 2019.

Once Brexit is finalized, thousands of legal agreements will need to be transferred between various brokerage firms’ legal entities operating either in the EU and the UK, which will be formally different as of March 29th, 2019 when the UK leaves Europe. Because this is new and unique problem the world hasn’t faced before, it required a new and unique solution.

Problem

Let’s say you’re an American hedge fund. You want to trade on European exchanges, so you sign agreements with brokers based in the UK, which up until this point gave you access to European markets.

But with Brexit looming, legal agreements with UK based firms will no longer be valid for trading in Europe. As a result, thousands of firms will need to switch the legal entities of their legal agreements to countries that can still do business in the EU. Rather than complicating things further by changing the terms of the deal or recreating existing agreements manually, most would rather just transfer the agreement to a legal entity within their firm based in a more beneficial country.

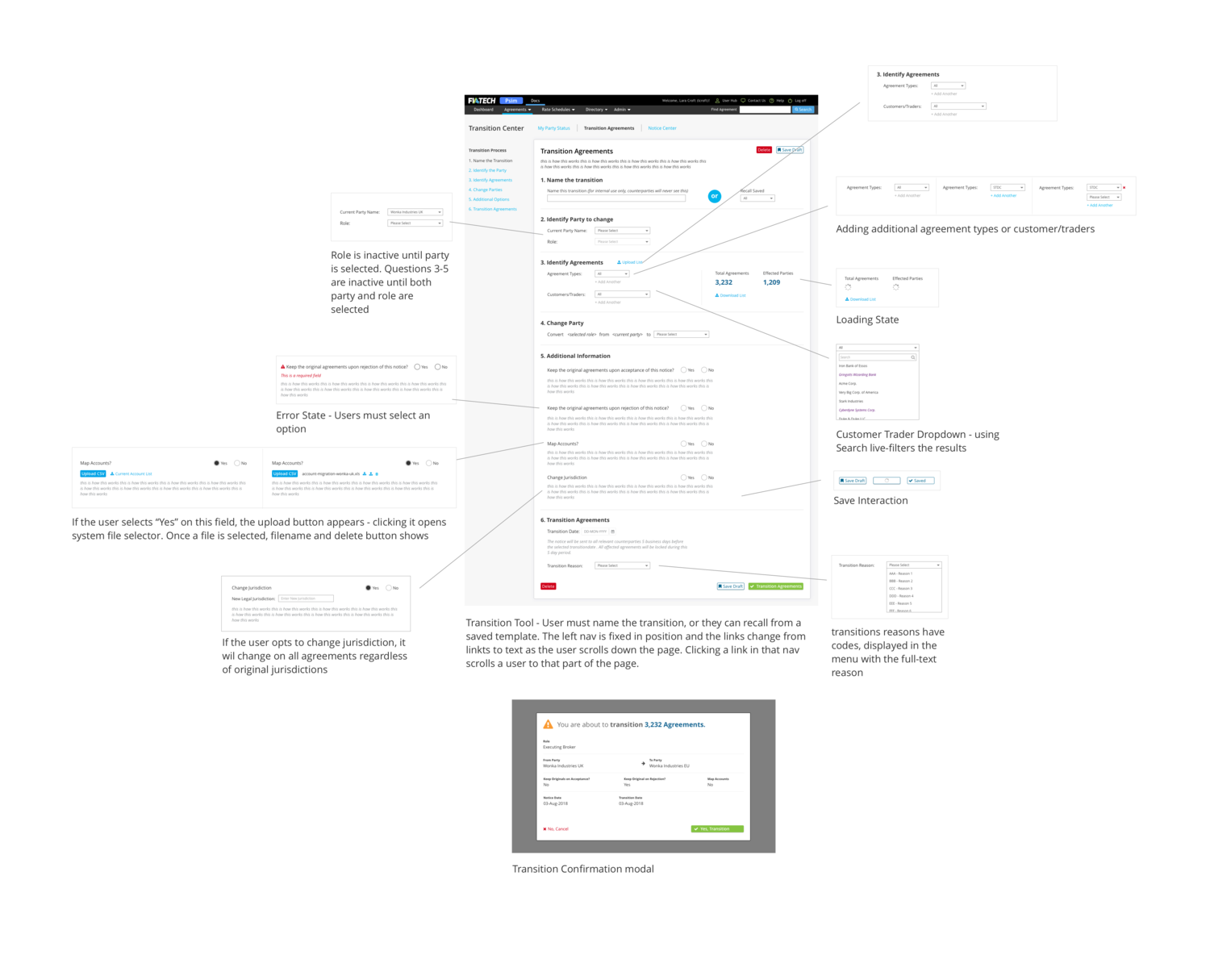

Our task was not only to create a protocol capable of repapering thousands of these legal agreements at scale, but also to devise an interface to make the work flow as painless as possible. On top of that, because we were dealing with legally binding contracts, we needed to make sure the platform’s documents were legally compliant for every country. All that, with an end of year 2018 deadline – to give firms time to transition before the March 29 cutoff.

Approach

Working with the legal teams with firms around the globe, we aimed to develop a protocol flexible enough to accommodate everyone. That was easier said than done — the requirements continuously changed as more firms were brought on.

We determined that the tool had to do 3 fundamental things well:

- Let firms opt-in to the transfer protocol

- Allow them to actually transfer the agreements

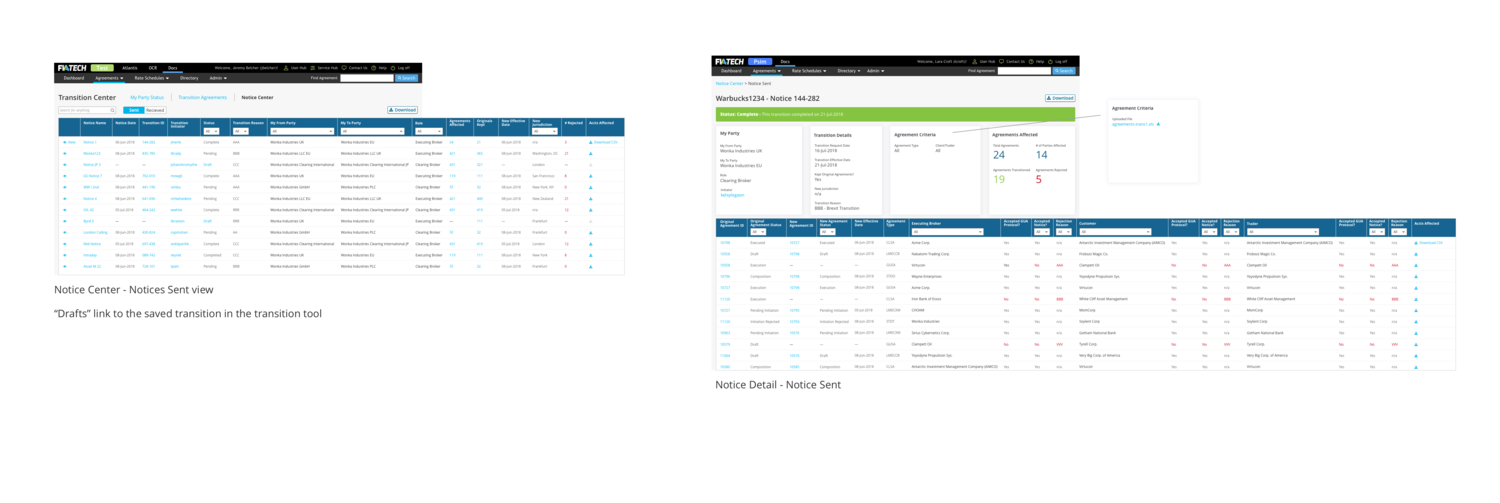

- Review what had been transferred.

Throughout the project, I worked hands-on with the user representatives of our client partners. I spoke with our users every two weeks during our our regular focus groups. This allowed us to discuss what they wanted and expected from the platform, and to align our understanding as best as possible given the unpredictable and unprecedented business environment Brexit had created.

At these meetings, I’d often present design concepts via Powerpoint or InVision prototypes, collecting lots of feedback early and often. There was little precedent to this kind of project, so this was the best way to minimize uncertainty. Until designers talk to real-life users, everything is just guesswork — it’s the user feedback that reveals the best path for the design process to take.

Then there was the legal component, which, for this particular project had millions, if not billions, of dollars at stake. Our team collaborated with legal teams from various firms across various countries to ensure compliance. It wasn’t enough that the design “just worked” – it needed to be legally compliant.

Solution

In the end, The transfer tool was an unqualified success, exceeding the customer’s expectations. Asset Managers and Brokers can now seamlessly transition the legal entities of their Give Up agreements, circumventing at least one of the disruptions from Brexit. Our platform single-handedly saves firms countless hours of busy work and millions of dollars in legal fees. It worked so well that law firms approached us to create similar tools for repapering legal agreements in other categories.

Conclusion

To date, we’ve helped more than 1,500 firms transition thousands of agreements — and saved everyone millions of dollars in legal fees with an original and more efficient solution.